MCNY WELCOMES ANNUAL ‘OUTLOOK’ FOR ESTIMATED U.S. AD & MARKETING SPEND IN 2024 – A $570 BILLION OPPORTUNITY, FUELED BY $36 BILLION IN DATA-RELATED SPEND

For the 18th consecutive year, the Marketing Club of New York has featured Winterberry Group’s Bruce Biegel, who reveals his annual recap of prior year ad spend, provides predictions on the year ahead – and discusses the business drivers behind it.

Thanks in part to an election, 2024 may prove to be a banner year – but it’s not a uniform pretty picture, attendees to our January 2024 program learned.

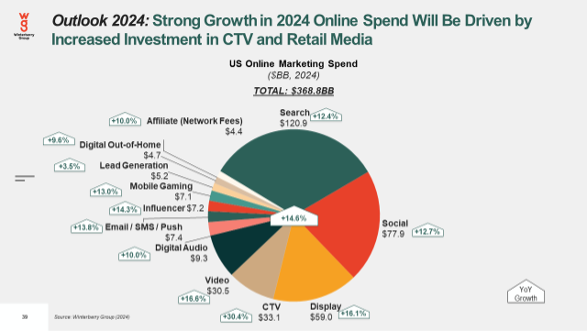

Estimated overall ad spending in U.S. will post a robust 10.4-percent growth in 2024, reaching $570 billion – fueled by $17 billion in political ad spending, and continued transformation of data-driven advertising, from connected television (CTV) to numerous digital ad channels where double-digit percentage growth is expected. That’s all according to Winterberry Group and its “Outlook for Advertising, Marketing and Data 2024” research estimates.

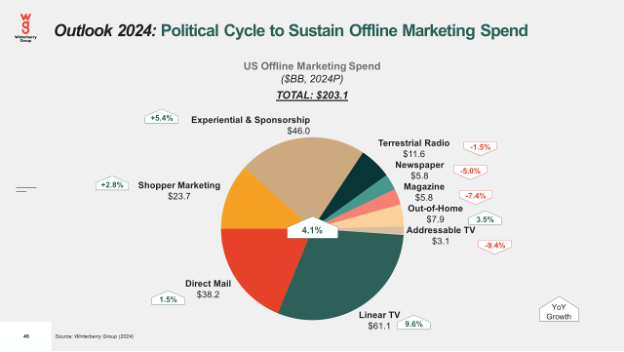

Offline media – which posted an overall ad spend decline in 2023 of 3.8 percent – should erase that decline in 2024, helped by the Election which will boost linear television in particular.

Current Business Drivers behind Ad Spend: Vote for Me

The predictions from the strategic consultancy also included a variety of business drivers and trends, from macroeconomic influences such as interest rates and unemployment, to advertising-specific concerns, among them the loss of third-party cookies as reliable household and individual identifiers for advertising, and their attempted replacement by a variety of technologies and techniques.

“Nearly half the projected ad spend growth will be driven by the forthcoming election cycle,” Biegel said, noting that the campaign for U.S. President and Members of Congress – which likely will be divisive – may dampen the ability of brands to connect with consumers, since brands tend to steer clear of ad-financing in media channels where controversy foments.

“Still, the investment in data-driven channels will flourish – where spending on data, data services and data infrastructure is predicted to top $36 billion in 2024, a 13.9-percent increase,” he said.

Retail Media Networks are Really Commerce Media Networks

“Another predominant trend is that retail media networks – with impact on display, search and social – are expanding to become ‘commerce media networks,’ where platforms with significant first-party data are leveraged to support targeted, measurable business objectives,” Biegel said. “Underpinning this growth is the need for a fast data infrastructure — the data layer — that enables the application of AI-led intelligence for both the buy side and sell side.”

According to the Winterberry Group predictions, online spending will post growth of 14.9 percent to an estimated $368.8 billion while offline spending will reverse 2023 declines and record ad spend growth of 4.1 percent to $203.1 billion, primarily driven by the political and major event cycle, the Winterberry Group predicts.

Among trends Biegel identified in his analysis:

- MACROECONOMICS: While a recession was averted in 2023 – continued high interest rates, inflation over target, and an uptick in unemployment – will stoke persistent uncertainty, dampening the outlook.

- HOT DIGITAL GETS HOTTER: While “traditional” digital spend – display, search and social — gets the lion-share of digital ad dollars, and should post double-digit growth again next year, the hottest categories are predicted to be CTV (30.4 percent growth), video (16.6 percent growth), and influencer (14.3 percent growth). Digital channels overall will account for 64% of ad spend.

- THE DATA LAYER: Data is no longer (just) a channel play – data for direct mail, data for email, data for interest-based advertising online, data for addressable and connected television – but rather an enterprise-wide intelligence infrastructure that supports media mix modeling, omnichannel marketing, triggered marketing, targeting, attribution and other ad-focused measurements. Still, legacy customer relationship management systems mean data silos linger, and applied intelligence is hampered.

- GENERATIVE AI AND MACHINE LEARNING: As privacy laws proliferate, at least at the state level for now, the new uptick in generative artificial intelligence (AI) adoption, and the machine learning that enables the algorithms that support creative versioning and 1:1 marketing will result in new regulatory scrutiny – bringing the potential for new data and AI restrictions. Advertisers and marketers will continue to invest in these tools, all the same.

- NAME THAT IDENTIFIER: Agencies and brands are reassessing their media spend, as attribution becomes harder with the fading third-party cookie. A higher reliance on media mix modeling – and watching for incremental changes in sales, leads and traffic – and a renewed focus on attention metrics collectively should ensue.

- OFFLINE WOES: Offline spending posted steeper declines than anticipated a year ago – with direct mail spend off by 9.8 percent in 2023, joining the print declines of magazine and newspapers. Unlike the latter print categories, however, direct mail spending should eke out a 1.5-percent increase this year.

Results of the full study, as a PDF, are available for download directly from Winterberry Group: https://winterberrygroup.com/marketing-advertising-data-outlook-presentation-2024

For 17 of the 18 years, Annual Outlook has been supported by a generous event sponsorship by Alliant. JoAnne Dunn, chief executive officer, Alliant reminded the crowd “you think our pens are good, our data’s so much better” – the former of which were used for active note taking among attendees – and who acknowledged Winterberry Group for its ongoing advisory role for strategic guidance. That advice, for the 18th year at MCNY, was well on display.

Related Posts

MCNY Announces Industry Executive Chet Dalzell of Digital Advertising Alliance to Serve as 2024 Club President

MCNY Announces Industry Executive Chet Dalzell of Digital Advertising Alliance to Serve as 2024 Club…

New Research Seeks to ‘Demystify the Data Layer’ – in the U.S., a $27-Billion Riddle

By Chet Dalzell, Digital Advertising Alliance Each and every year since 2008, the Marketing Club…

MCNY Welcomes Annual ‘Outlook’ for Estimated U.S. Ad & Marketing Spend in 2024

Alliant CEO JoAnne Dunn introduces Winterberry Group Senior Managing Partner Bruce Biegel who presented to…

Meet 2023 MCNY Silver Apple Honoree, Katie Keating

30 years ago, Katie Keating came to New York with a vision and never left…