MCNY KICKS OFF 2025: ‘ANNUAL OUTLOOK’ FOR U.S. AD, MARKETING and DATA SPEND TO GROW 6.1 PERCENT — WITH DIGITAL, CTV ACCELERATION; DECLINE IN LINEAR TV, PRINT

By Chet Dalzell, Digital Advertising Alliance

The U.S. economy is off to a solid start – with some uncertainties in tariffs – and advertising and marketing should reap solid gains this year, reports our featured speaker Bruce Biegel, senior managing partner, Winterberry Group, at Marketing Club of New York’s (MCNY) Annual Outlook luncheon and briefing on January 23, 2025.

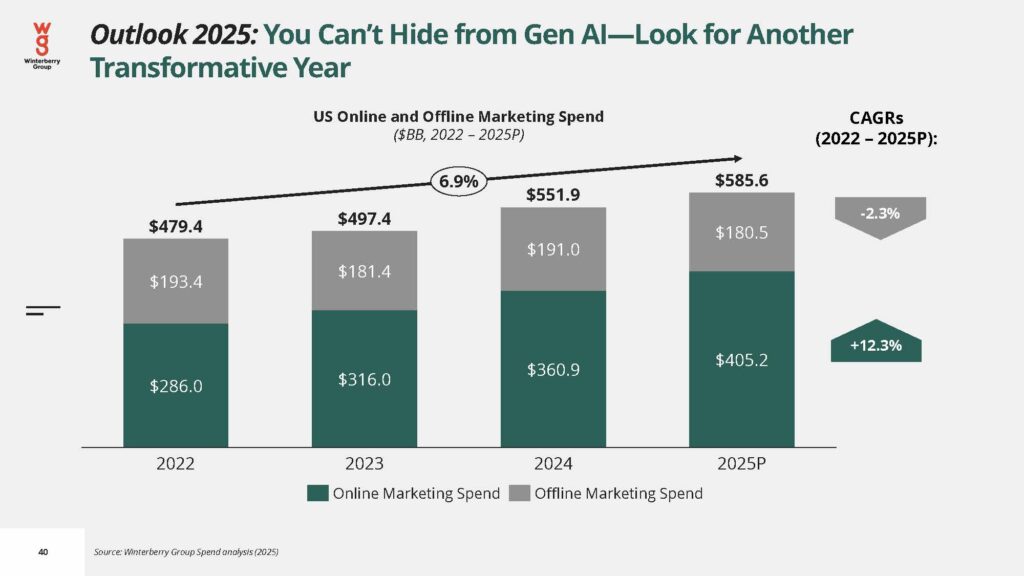

The transformation of the U.S. advertising, marketing and data landscape is accelerating, Biegel said, with media expenditures predicted to top $585 billion – 6.1-percent growth over 2024 – with marked shifts from linear television and many offline channels to largely digital, data-centric channels fueled by ad tech, analytics, and AI [artificial intelligence] investments.

By the end of 2025, offline channels overall will decline by an estimated 5.5 percent year over year, while online marketing spend will grow by 12.3 percent – with data, analytics and data infrastructure spending on all channels posting 6.0-percent growth, Winterberry Group predicts. U.S. economic expansion as seen in 2.5% Gross Domestic Product increase, helping to fuel growth.

Both the 2025 predictions and 2024 year in review are embodied in the report, “Outlook for Advertising, Marketing and Data 2025: Transformation Accelerates.” It’s the 19th consecutive year that Biegel has presented his annual findings, all of them at MCNY functions. (Alliant has provided an event sponsorship to the club since the initial presentation.)

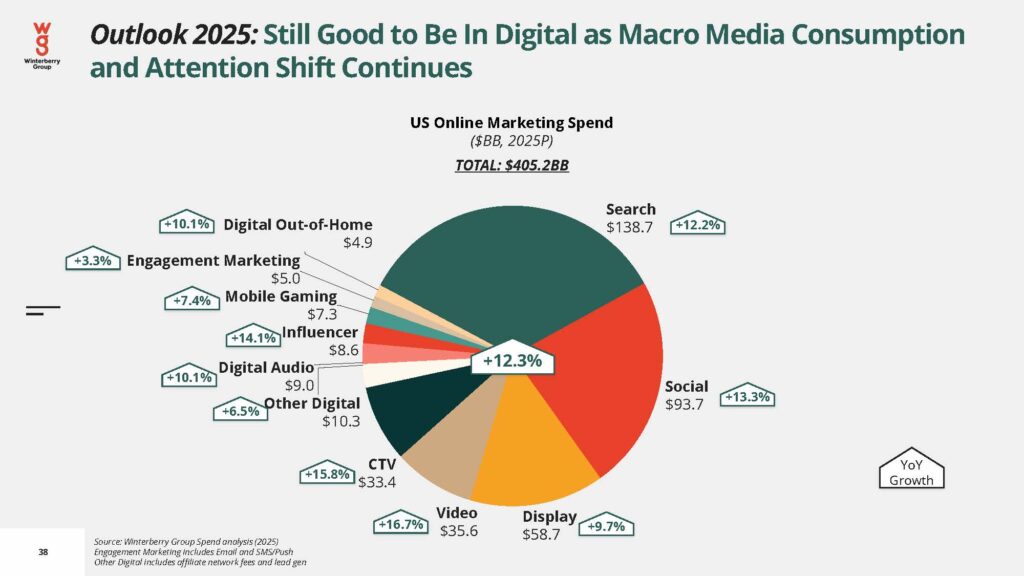

“There are significant business drivers here – fueled by data and tech investments,” study author Bruce Biegel, senior managing partner, Winterberry Group, said. “We see both connected commerce – the melding together of search, social, display, and retail ad networks with consumer and B2B transactions – and investments in the ad tech stack driven by data insights and generative AI – as being central to these transformative shifts in media spend.”

The report also shows that U.S. ad spend in 2024 grew by 11 percent – and 8.7 percent if excluding political advertising for Election 2024. The latter was nearly three times the corresponding growth in U.S. GDP last year. Last year’s market spending spree buoyed channels such as direct mail and linear television that are predicted to see declines this year, Winterberry Group reports. A preceding Winterberry Group report issued last month shows that direct mail advertising is becoming value-driven, rather than volume-driven.

Among selected additional findings from the report:

DIGITAL DOMINANCE

In 2024, U.S. digital marketing expenditures reached $360.9 billion – more than 65 percent of total online and offline spending combined. In 2020, when COVID-19 fully broke out, online marketing’s total expenditure share was 57 percent. In 2025, online marketing’s corresponding share will exceed an estimated 69 percent – surpassing $405 billion.

HOTTEST MEDIA CATEGORIES ONLINE

Search, social, CTV, video and influencer marketing each posted double-digit growth in 2024 – with a repeat performance expected in 2025.

CTV v. LINEAR – RISING AND FALLING

CTV advertising expenditures reached $28.8 billion in 2024 – compared to $58.9 billion for linear television (broadcast and cable). In 2025, CTV ad revenue is expected to jump 15.8 percent to $33.4 billion, while linear TV revenue will decline by 19.3 percent, falling to $47.5 billion. At some point – Winterberry Group estimates in 2027 — CTV will be the larger.

‘DATA LAYER’ INVESTMENT IS STRONG

U.S. marketing spend on data, data services and data infrastructure grew by 10 percent to reach $25.0 billion – helped by data layer investments and the U.S. General Election. Data services include identity resolution, analytics, measurement, attribution and data layer integration. Data infrastructure includes data management and collaboration platforms, among them privacy-enhancing technologies such as “clean rooms.”

AI AUTOMATION IS INCREASING CONTENT SPEND

It may be paradoxical, but investments in generative AI and machine learning, while automating content creation, is seeing organizations reallocate rather than reduce budgets – with an emphasis on producing content faster while maintaining quality and brand consistency.

CONNECTED COMMERCE POWERHOUSE

Marketing expenditures on connected commerce (social, search, display and first-party-data-driven retail media networks) grew by 18.7 percent per year from 2021 to 2025, rising cumulatively from $56.7 billion in 2021 to an estimated $112.6 billion by the end of 2025. Retail media networks account for two-thirds of such commerce.

TRADESHOW AND EXPERIENTIAL SPONSORSHIPS

Tradeshow and event advertising, and experiential and sponsorship advertising, have fully recovered from the COVID crisis – as measured in expenditures. Both vehicles – especially important to business-to-business marketers – are expected to surpass $25 billion and $22 billion in 2025, respectively.

“The tech stack is emerging as a single provider of intelligence and customer truth, but it is one built with hybrid solutions rather than a single platform,” Biegel said. “Increasingly, generative AI is diminishing the line between content and audience data, and intelligence is enabling mixed media modeling across channels.”

Results of the full study, as a PDF, are available for download from Winterberry Group:

Related Posts

MCNY Kicks Off Centennial Year Programming with ‘Annual Outlook’ 2026: Winterberry Group Expects 9.4-percent for U.S. Ad, Marketing and Data Spend in 2026 to Top $660B

Winterberry Group Senior Managing Partner Bruce Biegel MCNY KICKS OFF CENTENNIAL YEAR PROGRAMMING WITH ‘ANNUAL…

On Turning 100: It Starts with One…

By Chet Dalzell, 2026 MCNY President 2026 is a momentous year. The United States turns…

MCNY Announces 41st Annual Silver Apple Honorees: Five Marketing Leaders and One Corporation

Additional special awards to be bestowed for advocacy, innovation and ‘Green Apple’ for a rising…

MCNY Kicks Off 2025: ‘Annual Outlook’ for U.S. Ad, Marketing and Data Spend to Grow 6.1 Percent – with Digital, CTV Acceleration; Decline in Linear TV, Print

Winterberry Group Senior Managing Partner Bruce Biegel MCNY KICKS OFF 2025: ‘ANNUAL OUTLOOK’ FOR U.S.…