For the 17th consecutive year, Winterberry Group’s Bruce Biegel announced his highly anticipated “Annual Outlook,” predictions for 2023 marketing spending, replete with detailed data on notable budget drivers.

Biegel forecasts $509.2 billion in total advertising and marketing spend in 2023 — a record.

A year ago we were all flying high. We thought we were emerging from a stubborn global pandemic, and then two months into the year, Europe’s worst war since World War II ignited uncertainty, rapid inflation, more hiccups in supply chains — and a newly-determined Fed’s commitment to raise interest rates aggressively to levels not seen in more than a decade, prompting its own chilling effects.

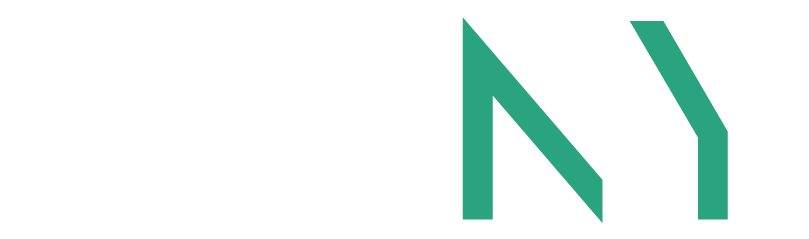

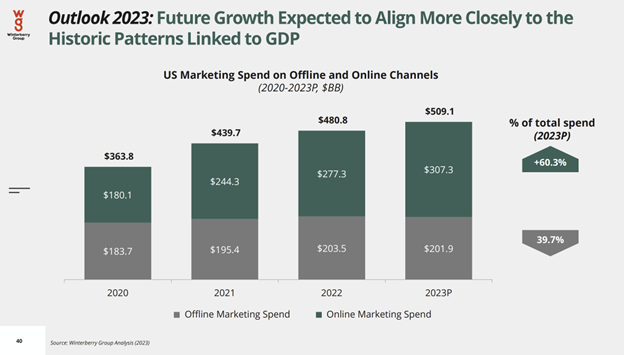

So, 2021’s hypergrowth fizzled by mid-year 2022 — and while the Winter Olympics and a hotly contested Midterm Election gave their usual shots in the arm — the total U.S. advertising and marketing spend went from red hot in the first half to mediocre by year’s end. Overall, that spend settled at $480.8 million, still a respectable 9.4 percent growth rate, ahead of inflation.

The lion’s share of that total ad spend went to digital, which surpassed offline spending for the first time in 2021. In 2022, all-digital-channels-combined topped $277 million in spend, a 21.7-percent increase over red-hot 2021. Offline media also recorded growth in last year — with addressable TV, linear TV, experiential marketing, outdoor/out-of-home, direct mail and shopper marketing all posting increases — and print (newspaper and magazines) continuing their respective declines.

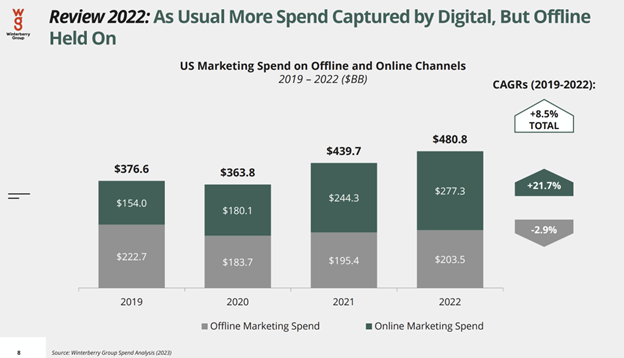

Under the hood in digital, the hottest channels were mostly visual: connected TV posted 46.5 percent growth; influencer media, 27.9 percent growth; digital video, 17.5 percent uptick; search, 16.1 percent growth; and, digital out-of-home, 15 percent growth.

Smart(er) Marketing: What’s the Data Angle?

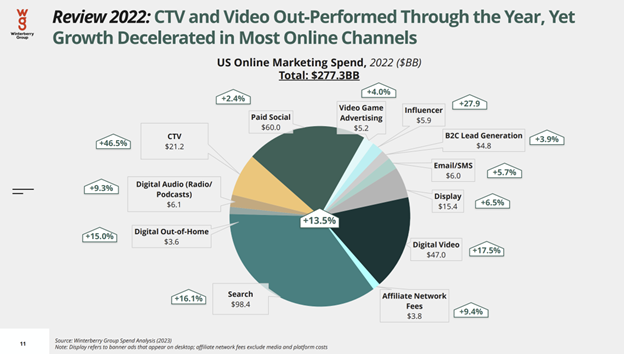

One of the hallmarks of Winterberry Group analysis is Biegel’s unique look at data spending for marketing – the data that drives identity, addressability, analytics and algorithms as brands manage their customer discovery, acquisition and retention efforts. Marketers who rely on digital, direct mail, addressable TV and email all depend on quality data – and 2022 wound up being a record year for such golden bits and bytes: adding up to $31.7 billion, a 16.7 percent spike over 2021.

One of the big drivers, Biegel reported, was the need to come up with cookie and mobile ad ID alternatives online – finding other means to preserve addressability for both prospects and customers across browsers, devices, and platforms.

A Potpourri of Marketing Insights

Among other trends and highlights for 2023, according to Biegel and Winterberry Group:

- Retail and vertical media marketplaces are racing ahead, with some forecasts putting the market size at $100 billion in 2026 from $45 billion in 2022. Search and display ads are driving consumer transactions, with cost per order as equally important a metric as return on advertising spend. Can merchandising and sales alignment keep in step?

- Programmatic comes to direct mail. Behavioral, event-driven mail may be a small fraction of total direct mail spend, but it’s expected to quintuple from 2018 to 2025 – particularly as inflation in digital performance media (display, search, social) on a CPM-basis has skyrocketed.

- In B2B, account-based marketing spend grew 13 percent in 2022 over 2021 – and is driving enterprise investments in marketing automation, analytics and data services.

- Connected TV and linear TV convergence continues, even as the speed bumps linger. The legacy TV crowd and the digital TV crowd are not yet speaking the same language on audience measurement and engagement. The buys may be bundled, but fraud, viewability, frequency capping and other integration challenges remain.

- The consumer’s path to CTV also is fragmented: streaming apps for video on demand; broadband ISPs, set-top-box providers, gaming and streaming devices, and smart TV original equipment manufacturers — all of which brands must navigate in their respective media buys.

- As cookies and mobile ad IDs fade, the race for “first-party data relationships” is on and identity solutions, based on consent, gain traction. However, consent remains hard to scale, so legacy cookie, contextual and analytics reliance are filling in gaps. Will a federal privacy regulation emerge to preserve interest-based, behavioral advertising?

- Artificial intelligence, such as machine learning and conversational AI, are moving quickly to the core of marketing — with applications for paid media, site optimization, personalization, market research, predictive and prescriptive analytics, measurement and attribution, data quality, customer service, content generation, and creative development, among other applications.

All told, Beigel predicts offline ad spend will decline by 0.7 percent this year to $201.9 billion, and online ad spend will grow by 10.8 percent – netting out a respectable total growth of nearly 5.9 percent. Data spend will grow even faster – by 7.4 percent. That should make marketing that much “smarter” — as long as we have the bench strength to draw the right conclusions.

It’s a critical time to be a left-brain marketer – even as we need the right brain to keep us all engaged and inspired. For another year, we have Biegel’s take on how we might be able to get all this done, and gather again in 2024 with a new appreciation on what we’ve achieved. Now, let’s get to it.

The full report from Winterberry Group is available for download [free registration].

About the Author

Chet Dalzell has more than 25 years of public relations management and expertise in service to leading brands in consumer, donor, patient and business-to-business markets, and in the field of integrated direct marketing. He serves on the Association of National Advertisers International ECHO Awards Board of Governors, as a Board Member to the Marketing Club of New York, and is senior director, communications and industry relations, with the Digital Advertising Alliance, a privacy self-regulatory program for data collection for digital and mobile interest-based advertising.