It’s nearly impossible to understate what transpired in advertising and marketing media spend in 2021, given a second year of a global pandemic. No one—not even Bruce Biegel, senior managing partner at The Winterberry Group—saw it coming: A full-fledged rally in advertising of unprecedented magnitude. Though guess what: That rally is set to continue, at least for many.

The more than 100 online attendees of the Direct Marketing Club of New York (DMCNY) Annual Outlook received this scoop, as Biegel gave his annual review of 2021—and his predictions for 2022—regarding the United States advertising marketplace. The usually live event was yet again made virtual this year because of the COVID Omicron variant’s rapid spread.

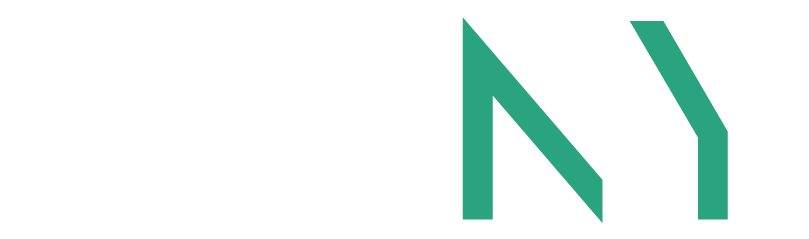

Last year, the COVID recession of 2020 (in ad spend, where media budgets contracted by 4.8 percent) came to an abrupt halt. In 2021, it was as if every consumption pattern of Americans before the public health disaster had been restored, though differently. As affected and afflicted as we all (still) are, it seems that brands couldn’t or wouldn’t hold back. A frenzy in acquisition and retention spending ensued, perhaps brought on by stimulus, and perhaps a pent-up need to “get on with life”—disease be damned. Certainly, most brands were not being conservative with their purse, Biegel reported.

Unprecedented onslaught

In 15 years of making annual prognostications on media spends, Biegel never had seen—and neither had we—a 21 percent increase in U.S. marketing spend growth year over year. Ad spend growth “normally” outstrips Gross Domestic Product (GDP) growth by a magnitude of 2X. Biegel had predicted a recovery, but not quite like this. In 2021, this ad-spend figure was nearly 4X GDP growth: “An onslaught!”

What happened? And what will happen this year?

Bruce gave us the good word in his presentation title: “The rally will continue.” Yet the froth will settle—albeit to a growth in spend of a robust 11.8 percent overall, still 3X GDP projected growth. Yet not all channels are sharing in the love.

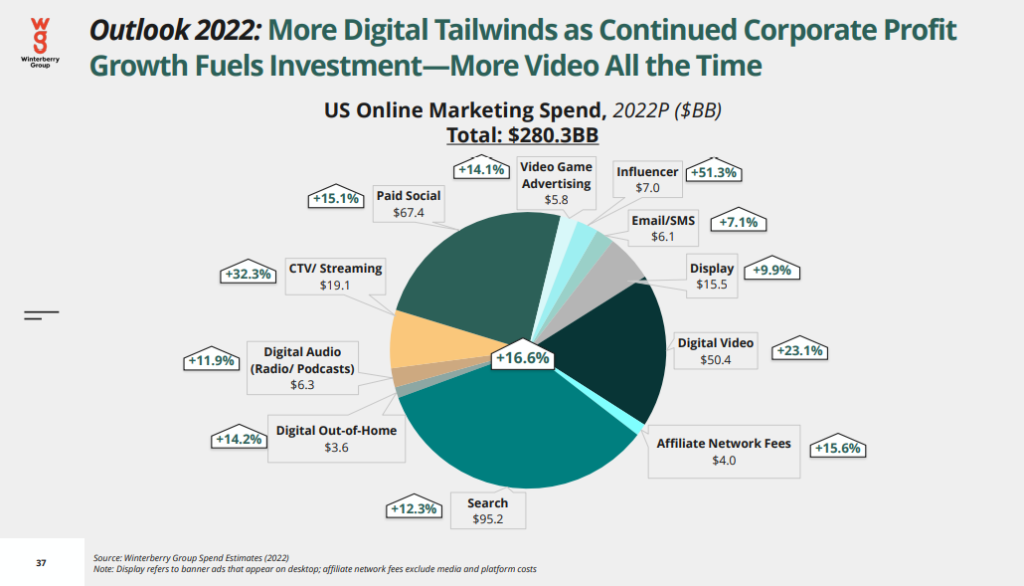

For 2022, offline media spending—at $207 billion—will growth by 5.9 percent, led by addressable TV, traditional outdoor, and experiential/sponsorships. Even linear television and direct mail might garner 3.5 percent growth each, he predicted. Newspapers and magazines will continue to contract, even faster than they had previously.

We’ve been digitally transformed

In Beigel’s words, perhaps we’ve passed the point of “digital transformation.” We are transformed.

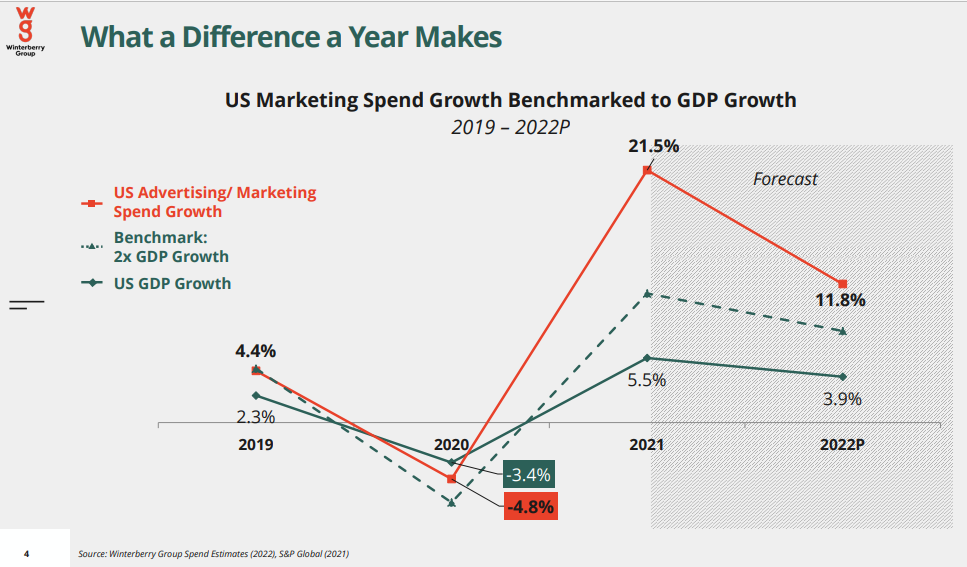

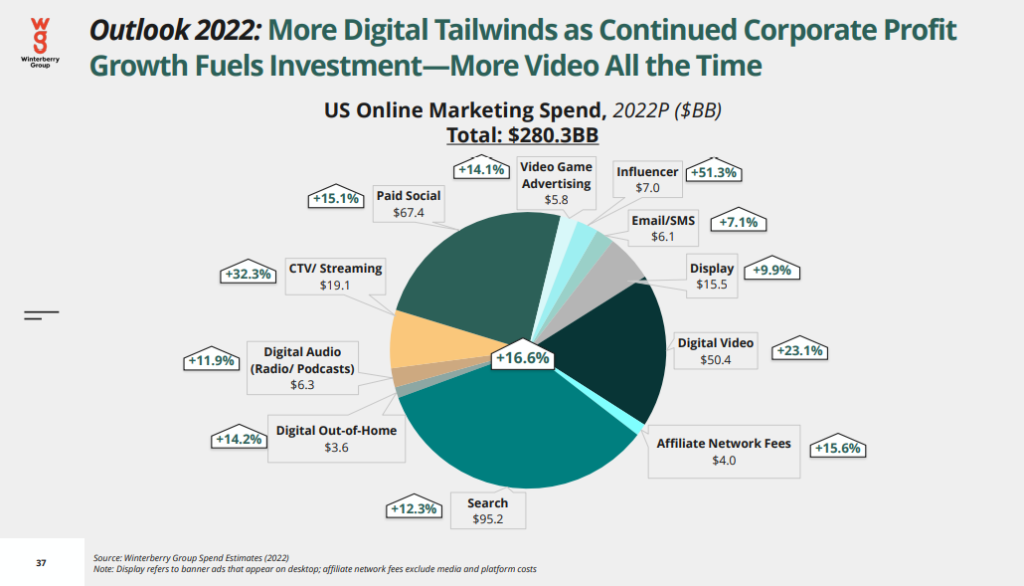

Online media spending this year will surpass $280 billion, Biegel forecasts, posting 16.6 percent growth overall—nearly three times the rate of growth of offline spending. Hot categories will include connected television/streaming (up 32.2 percent); digital video (up 23.1 percent); and influencer marketing (up 51.3 percent). Search, social, display, and email all will post growth of 7 percent or higher—some of it driven by media inflation, and some of it simply more volume.

In the driver’s seat: intelligence applied

Winterberry Group’s media outlook forecasts always provide excitement, especially in a growth year. However, it’s the drivers of channel and media spend that perhaps assigns DMCNY Annual Outlook its must-attend status. The insights are always profound. Among Biegel’s “macro” trends this year:

- Marketers layer, extract, analyze, and deliver: Consumers expect (or demand) consistent, exceptional experiences across platforms. They need to be recognized and rewarded with relevance. Thus, marketers are in a quest to accelerate omnichannel integrations—busting silos of marketing, service, and supply chains.

- Retail is hot, hot, hot: Retail media ad spend will double from 2020 to 2022, to $40 billion, as retailers invest in online marketplaces, online storefronts, and integration of inventory and physical shelves. DTC (direct-to-consumer) is no longer just about e-commerce, a website, or a mobile sale.

- Privacy is all about finding the right balance: While zealots may seek to “ban surveillance advertising,” there’s likely no forthcoming federal legislation this year, in spite of a growing state patchwork of expensive laws that marketers must adhere to. In reality, brands are already planning for the post-third-party-cookie world—investing in first-party data, cohorts, contextual, clean rooms, and other technologies to enable some measure of targeting, relevance, and attribution, albeit not without serious challenges for publishers and the ad-financed economy.

- In-game where gamers are: There are 227 million video game players in the U.S. and in-game ads are expected to reach $5.8 billion this year. The metaverse is not new, but many of the immersive technologies now coming to market offer new ways to connect consumers with brands there are.

- Direct mail is an acquisition channel: Fully 80 percent of direct mail was focused on acquisition in 2021, with advertising mail volume approaching that of 2019 level. Acquisition mailings grew by 14.6 percent in the calendar year. Customer retention mailings also grew, by 7.9 percent, driven by cross-selling and loyalty marketing, Biegel said, citing data from Mintel/Comperemedia.

- Influencers are the new affiliates: With the rise of social commerce, influencers are now acting as affiliates—with $11 billion in influencer marketing spend in 2021. “Yet who owns the influencer relationship between creative, paid media, and digital commerce?” Biegel asked. And “how hard will it be to manage experience, creators, [brand] suitability, safety, and measurement?”

Help wanted: Who can master all this?

What is perhaps the Great Talent Search of 2022 is following the Great Resignation of 2021, Biegel reported, as the lexicon of DEI (diversity, equity, inclusion), ESG (environmental and social governance), and WFA (work from anywhere) join the in-house, on-shore, and offshore considerations of increasing one’s bench strength. Where do brands, agencies and adtech/martech firms find market-ready talent equally fluent with creative and data, inspiration and measurement? Workers with those skill sets have many options.

Those enterprises that help brands figure this out also are set to gain. Last year, venture capital funds raised a collective $130 billion. Investments neared $350 billion, and exits reached $177 billion. While market valuations for Big Tech will be under pressure in 2022, there’s a lot of cash chasing new investments.

Having an insight-loaded roadmap for the year commands our attention and sparks conversations. When we come together in January 2023, we’re hopeful Biegel’s Annual Outlook will keep us smiling. Either way, with this year’s projections in hand, we certainly will be prepared.

Download Bruce’s full presentation here.

Additional coverage can be found on MediaPost here and here.